Emanuel Crunchtime Series: Unveiling the Complexities of Basic Federal Income Tax

The world of taxation can be a labyrinthine maze, filled with intricate laws and regulations that can leave even the most astute individuals feeling bewildered. Emanuel Crunchtime, the renowned tax expert, has meticulously crafted a series of guides to demystify the complexities of tax codes, empowering individuals to navigate the tax landscape with confidence. In this comprehensive article, we will delve into the intricacies of Basic Federal Income Tax, armed with the insights from Emanuel Crunchtime's indispensable guide.

4.2 out of 5

| Language | : | English |

| File size | : | 4824 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |

Understanding the Basics of Federal Income Tax

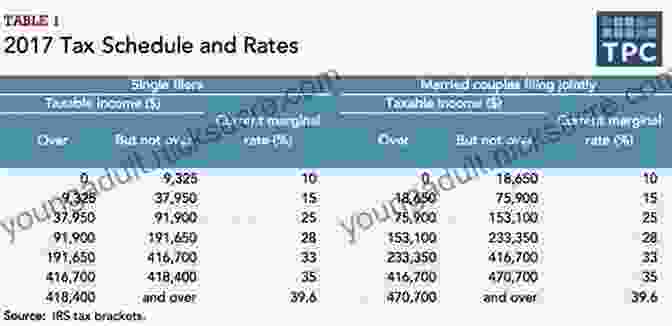

At the heart of federal income tax lies a straightforward concept: individuals are obligated to pay a portion of their income to the government. This obligation stems from the Internal Revenue Code (IRC),a vast compendium of tax laws that govern the taxation of individuals and businesses. The IRC establishes various tax brackets, each associated with a specific tax rate. The higher your income, the higher the tax bracket you fall into, resulting in a higher tax liability.

Calculating Your Taxable Income

Before you can determine your tax liability, you must first ascertain your taxable income. This involves subtracting specific deductions and exemptions from your gross income. Deductions encompass expenses that reduce your taxable income, such as mortgage interest, charitable contributions, and certain medical expenses. Exemptions, on the other hand, represent fixed dollar amounts that are subtracted directly from your income before taxes are calculated. Understanding the nuances of deductions and exemptions is paramount in maximizing your tax savings.

Navigating Tax Credits and Deductions

The tax code offers a myriad of tax credits and deductions designed to incentivize specific behaviors or provide relief to certain taxpayers. Tax credits directly reduce your tax liability dollar for dollar, while deductions lower your taxable income. Exploring the eligibility criteria and maximizing your utilization of these tax-saving tools can significantly reduce your overall tax burden.

Filing Your Tax Return

Once you have calculated your taxable income and accounted for any applicable deductions and credits, it's time to file your tax return. The IRS provides various methods for filing, including online filing, mail-in filing, and professional tax preparation services. Choosing the method that aligns with your comfort level and resources is essential. Remember to gather all necessary documentation, such as W-2 forms, 1099 forms, and any records of deductions or credits you claim.

Common Tax Pitfalls to Avoid

Navigating the tax code can be fraught with potential pitfalls. To ensure accuracy and avoid costly mistakes, be wary of common errors such as:

- Incorrectly calculating your taxable income

- Missing out on eligible deductions or credits

- Making mathematical errors on your tax return

- Filing your tax return late

Emanuel Crunchtime's Expert Guidance

Emanuel Crunchtime's Basic Federal Income Tax guide is an invaluable resource for mastering the intricacies of tax laws. This comprehensive guide provides:

- Clear explanations of tax concepts and terminologies

- Step-by-step instructions for calculating your taxable income

- Detailed information on deductions, credits, and exemptions

- Insider tips for maximizing your tax savings

- Real-world examples to illustrate complex tax scenarios

By leveraging the insights from Emanuel Crunchtime's guide, you can confidently file your taxes, minimize your tax liability, and avoid common pitfalls.

Understanding the complexities of federal income tax is not for the faint of heart. However, with the right guidance, you can navigate the tax code with confidence and accuracy. Emanuel Crunchtime's Basic Federal Income Tax guide serves as your indispensable companion throughout this endeavor. Whether you are a seasoned tax filer or a novice just starting to comprehend the tax landscape, this comprehensive guide will empower you to make informed decisions and optimize your tax situation. Embrace the opportunity to master basic federal income tax and take control of your financial well-being.

4.2 out of 5

| Language | : | English |

| File size | : | 4824 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Peter Townsend

Peter Townsend Petros Efthymiou

Petros Efthymiou Emily Souder

Emily Souder Miranda Green

Miranda Green Cheryl Alkon

Cheryl Alkon Douglas Henderson Jr

Douglas Henderson Jr Tigran Bagdasaryan

Tigran Bagdasaryan Chanel Craft Tanner

Chanel Craft Tanner Schoolhouse Heaven

Schoolhouse Heaven Tanya Lee Stone

Tanya Lee Stone Jodi Picoult

Jodi Picoult Tea Rozman Clark

Tea Rozman Clark Mirabai Starr

Mirabai Starr Lisa Preston

Lisa Preston Kevin Thomas

Kevin Thomas Beth A Leonard

Beth A Leonard Angela Eckhoff

Angela Eckhoff Laura Bogen

Laura Bogen Richard Hibshman

Richard Hibshman Dan Heath

Dan Heath Guy Evans

Guy Evans Tim Thayne

Tim Thayne Rebecca Serle

Rebecca Serle Cate Tiernan

Cate Tiernan Cynthia Nims

Cynthia Nims Barak Ariel

Barak Ariel Dawn Griffiths

Dawn Griffiths Jerry Toner

Jerry Toner R E Burrillo

R E Burrillo Charlotte Klaar Phd

Charlotte Klaar Phd Harold S Koplewicz

Harold S Koplewicz Karen Sternheimer

Karen Sternheimer Angela Leslee

Angela Leslee Tina Nelson

Tina Nelson Viviana Altuve

Viviana Altuve Tiara Mcclure

Tiara Mcclure James M Johnston

James M Johnston Jeff Fleischer

Jeff Fleischer Joe Peta

Joe Peta John Sonmez

John Sonmez Yvonne Choquet Bruhat

Yvonne Choquet Bruhat Andy Jurinko

Andy Jurinko Joseph Phillips

Joseph Phillips Frank Deford

Frank Deford Jeffrey Lee

Jeffrey Lee Gillian Price

Gillian Price Leonard Lueras

Leonard Lueras Donna Mott

Donna Mott Ed Stafford

Ed Stafford Karl Beecher

Karl Beecher Ken Dryden

Ken Dryden Ellen Frank

Ellen Frank Emma Dalton

Emma Dalton Richard G Brown

Richard G Brown Neil Hawkesford

Neil Hawkesford Robyn Wideman

Robyn Wideman John B Nici

John B Nici Wynne Foster

Wynne Foster Stephen Jungmann

Stephen Jungmann Anna Rashbrook

Anna Rashbrook Emiko Jean

Emiko Jean M J Fievre

M J Fievre United States Government Us Army

United States Government Us Army Dave Smith

Dave Smith Stephen Grossberg

Stephen Grossberg L S Boos

L S Boos Avinash Navlani

Avinash Navlani W Todd Woodard

W Todd Woodard Mitch Horowitz

Mitch Horowitz Ryan D Agostino

Ryan D Agostino Andy Tyson

Andy Tyson Mark Synnott

Mark Synnott Stefan Hunziker

Stefan Hunziker Angel Millar

Angel Millar Thomas Golf

Thomas Golf Robert Lindsay

Robert Lindsay Stephen Lynch

Stephen Lynch Ingrid S Clay

Ingrid S Clay Rebecca Hemmings

Rebecca Hemmings Cap N Fatty Goodlander

Cap N Fatty Goodlander Humberto G Garcia

Humberto G Garcia Rodney Castleden

Rodney Castleden Scott Stillman

Scott Stillman Jason Hogan

Jason Hogan Kent David Kelly

Kent David Kelly Christina Reese

Christina Reese Sabbithry Persad Mba

Sabbithry Persad Mba Kate Le Roux

Kate Le Roux Keith Elliot Greenberg

Keith Elliot Greenberg Margaret Visser

Margaret Visser Lindsay Ford

Lindsay Ford Howard Davis

Howard Davis Aaron Wilson

Aaron Wilson Kim West

Kim West Otto Rahn

Otto Rahn Shenila Khoja Moolji

Shenila Khoja Moolji Kathy Freston

Kathy Freston David Kinney

David Kinney Dan Ariely

Dan Ariely Lynn Palm

Lynn Palm Sandy Tolan

Sandy Tolan Andy Dowsett

Andy Dowsett Mtg Editorial Board

Mtg Editorial Board Bill Schneider

Bill Schneider Robin Ray Green

Robin Ray Green Caspar Melville

Caspar Melville Jenna Helwig

Jenna Helwig William Ayers

William Ayers Fredrik Backman

Fredrik Backman Lidia Bastianich

Lidia Bastianich Scott Meyer

Scott Meyer Milton Roth

Milton Roth Jim Prime

Jim Prime Kat Anderson

Kat Anderson Janet Menzies

Janet Menzies Tovar Cerulli

Tovar Cerulli Charney Herst

Charney Herst Angelo Lowery

Angelo Lowery Matthew D Dewar

Matthew D Dewar Carlo Rovelli

Carlo Rovelli Keith Crowley

Keith Crowley Marc Charles

Marc Charles Christopher Nyerges

Christopher Nyerges Andy Schell

Andy Schell Peter Finch

Peter Finch Chip Heath

Chip Heath Diana Nyad

Diana Nyad Mercedes Pollmeier

Mercedes Pollmeier David Herres

David Herres Eugene P Northrop

Eugene P Northrop Michael Driscoll

Michael Driscoll Ted Sandling

Ted Sandling Adam Skolnick

Adam Skolnick Mark Wells

Mark Wells Michael V Uschan

Michael V Uschan Christina Hillsberg

Christina Hillsberg George Johnson

George Johnson Rebecca Solnit

Rebecca Solnit Ryan Bow

Ryan Bow Madison Lee

Madison Lee David C Keehn

David C Keehn Yuu Tanaka

Yuu Tanaka Cory Mortensen

Cory Mortensen Dhonielle Clayton

Dhonielle Clayton Jim Saccomano

Jim Saccomano Marie Myung Ok Lee

Marie Myung Ok Lee Judith S Beck

Judith S Beck Robin Benway

Robin Benway Donna Helen Crisp Jd Msn Rn Pmhcns Bc

Donna Helen Crisp Jd Msn Rn Pmhcns Bc Hourly History

Hourly History Tirzah Price

Tirzah Price Daniel Friedmann

Daniel Friedmann Lutz Hanseroth

Lutz Hanseroth Oliver Burkeman

Oliver Burkeman Kari Marie Norgaard

Kari Marie Norgaard Ben Ehrenreich

Ben Ehrenreich Christopher O Kennon

Christopher O Kennon J D Swanson

J D Swanson Madeleine Roux

Madeleine Roux Tom Chatfield

Tom Chatfield Nicholas Jubber

Nicholas Jubber Mark Rosenman

Mark Rosenman James Quinn

James Quinn George E Hein

George E Hein Keylee C Hargis

Keylee C Hargis Roger Craig

Roger Craig Tristan Higbee

Tristan Higbee D M Davis

D M Davis Latonya J Trotter

Latonya J Trotter Diana Winston

Diana Winston Rebecca Boggs Roberts

Rebecca Boggs Roberts Violet White

Violet White Jorge Ramos Mizael

Jorge Ramos Mizael Joyce Yang

Joyce Yang Rashaun Johnson

Rashaun Johnson Hajime Isayama

Hajime Isayama Tim O Connor

Tim O Connor Stephen Cheney

Stephen Cheney Sir Edmund Hillary

Sir Edmund Hillary Sandra Steingraber

Sandra Steingraber Joseph Mazur

Joseph Mazur Angel Burns

Angel Burns Margaret Jordan Halter

Margaret Jordan Halter T R Fehrenbach

T R Fehrenbach Jonathan Gottschall

Jonathan Gottschall Robb Manning

Robb Manning Nicole Smith

Nicole Smith Gerard Siggins

Gerard Siggins Lisa Marie Mercer

Lisa Marie Mercer David E Jones

David E Jones Eric Schmitz

Eric Schmitz Pete Dunne

Pete Dunne Raynor Winn

Raynor Winn Robyn Harding

Robyn Harding Samir P Desai

Samir P Desai Andy Crowe

Andy Crowe Caryl Say

Caryl Say Mark Kernion

Mark Kernion Joel J Lerner

Joel J Lerner Steve Hindman

Steve Hindman Devaki Lakshmi

Devaki Lakshmi Rawdon Wyatt

Rawdon Wyatt Capn Fatty Goodlander

Capn Fatty Goodlander Elizabeth Kaledin

Elizabeth Kaledin Rachel Connelly

Rachel Connelly Meg Long

Meg Long Rachel Hutt Phd

Rachel Hutt Phd Kristina Statler

Kristina Statler Dennis Rainey

Dennis Rainey Andy Mitchell

Andy Mitchell Richard Bate

Richard Bate John Geiger

John Geiger Katrina Cope

Katrina Cope Judith Hoare

Judith Hoare Richard Lemaster

Richard Lemaster Kristen Jervis Cacka

Kristen Jervis Cacka Lynn Lyons

Lynn Lyons Robert Dudley

Robert Dudley Linda Sivertsen

Linda Sivertsen Robert E Stake

Robert E Stake Donald N Yates

Donald N Yates Andy Peloquin

Andy Peloquin Miles Olson

Miles Olson Wayne Mcghie

Wayne Mcghie Marie Brennan

Marie Brennan Bret A Moore

Bret A Moore Jay Matthews

Jay Matthews Ellen J Langer

Ellen J Langer Martin Volken

Martin Volken Phil Burt

Phil Burt Sharon Strand Ellison

Sharon Strand Ellison Michael Tomasello

Michael Tomasello Ben Bleiweiss

Ben Bleiweiss Jeffrey Thurston

Jeffrey Thurston Chris Santella

Chris Santella Shreya Ramachandran

Shreya Ramachandran Laura Hillman

Laura Hillman Rafael Gordillo Naranjo

Rafael Gordillo Naranjo Leanne Ely

Leanne Ely Nicholas D Kristof

Nicholas D Kristof Tim Macwelch

Tim Macwelch Michele Borba

Michele Borba Stacy Mccullough

Stacy Mccullough Rufus Estes

Rufus Estes Alberta Hawse

Alberta Hawse Israelin Shockness

Israelin Shockness Mark W Steege

Mark W Steege Afra J Zomorodian

Afra J Zomorodian Nick Bradley

Nick Bradley Ray Walker

Ray Walker Rosie Daley

Rosie Daley Mary Pipher

Mary Pipher Angela Smith

Angela Smith Tom Allen

Tom Allen Kathy Hoopmann

Kathy Hoopmann Andy Farrell

Andy Farrell Susan Burton

Susan Burton Catherine Mccord

Catherine Mccord G K Derosa

G K Derosa Karen Elliott House

Karen Elliott House Mark Remy

Mark Remy Kyle Graves

Kyle Graves Warren Sande

Warren Sande Dave Gray

Dave Gray Mark J Musser

Mark J Musser Judea Pearl

Judea Pearl Harry Fairhead

Harry Fairhead Jordan Summers

Jordan Summers Patrick M Lencioni

Patrick M Lencioni Shane O Mara

Shane O Mara Ryan Beck

Ryan Beck Marilyn Burgos

Marilyn Burgos Alex Wolf

Alex Wolf David Goodman

David Goodman Angela C Wu

Angela C Wu Carlos Acevedo

Carlos Acevedo Angelo Chiari

Angelo Chiari Jeff Mach

Jeff Mach Jim Posewitz

Jim Posewitz Germano Dalcielo

Germano Dalcielo Thais Nye Derich

Thais Nye Derich Kim Foley Mackinnon

Kim Foley Mackinnon Chris Chelios

Chris Chelios Mark Shepherd

Mark Shepherd Peter Gibson

Peter Gibson Chef Maggie Chow

Chef Maggie Chow Samuel B Green

Samuel B Green William Bryant Logan

William Bryant Logan Robyn Ryle

Robyn Ryle Wendy Rosenoff

Wendy Rosenoff Bradley Charbonneau

Bradley Charbonneau Pete Sampras

Pete Sampras William E Hearn

William E Hearn Kevin Hunter

Kevin Hunter John Samuel Barnett

John Samuel Barnett George Noory

George Noory Eliot Schrefer

Eliot Schrefer Manik Joshi

Manik Joshi Sam Fury

Sam Fury Murtaza Haider

Murtaza Haider Nicholas Epley

Nicholas Epley Jessica Jung

Jessica Jung Bob Gordon

Bob Gordon Angela Thayer

Angela Thayer Elly Molina

Elly Molina Bradley T Erford

Bradley T Erford Jenny Smith

Jenny Smith Ruby Lang

Ruby Lang John C Maxwell

John C Maxwell Florian Freistetter

Florian Freistetter Jo May

Jo May Lawrence Goldstone

Lawrence Goldstone Howell Raines

Howell Raines Barry Pickthall

Barry Pickthall Elizabeth Foss

Elizabeth Foss Jennifer Bohnet

Jennifer Bohnet Joy Williams

Joy Williams Dave Duncan

Dave Duncan Alessio Mangoni

Alessio Mangoni Erin Moulton

Erin Moulton Bob Swope

Bob Swope Ariel Henley

Ariel Henley Eli Wilson

Eli Wilson Jon Ronson

Jon Ronson Lee Cronk

Lee Cronk Stuart Lawrence

Stuart Lawrence Lois A Ritter

Lois A Ritter Tara Sim

Tara Sim Gary B Meisner

Gary B Meisner Scott Alan Johnston

Scott Alan Johnston Frederick Aardema

Frederick Aardema Dwight E Neuenschwander

Dwight E Neuenschwander Angelo Tropea

Angelo Tropea Jane M Healy

Jane M Healy Massimo Florio

Massimo Florio Jenna Blough

Jenna Blough Dr Eva Beaulieu

Dr Eva Beaulieu Muako Maepa

Muako Maepa Lin Wellford

Lin Wellford Tom Dymond

Tom Dymond Andy Puddicombe

Andy Puddicombe Jamie Kuykendall

Jamie Kuykendall Thomas Gilovich

Thomas Gilovich Tim Larkin

Tim Larkin Teresa Parker

Teresa Parker Angelina J Steffort

Angelina J Steffort Robert Zubek

Robert Zubek Shalabh Aggarwal

Shalabh Aggarwal Angela Stancar Johnson

Angela Stancar Johnson Sam Bleakley

Sam Bleakley Greg Prato

Greg Prato Ruth Benedict

Ruth Benedict Arlin Smith

Arlin Smith Deborah Wall

Deborah Wall Julia Reed

Julia Reed Jodi Shabazz

Jodi Shabazz Rodney Paul

Rodney Paul Stephanie Land

Stephanie Land Ben Campbell

Ben Campbell Kenneth R Ginsburg

Kenneth R Ginsburg Joshua Clark

Joshua Clark Kim Dragoner

Kim Dragoner Rob Willson

Rob Willson Richard L Sites

Richard L Sites Jessica Wolstenholm

Jessica Wolstenholm Stephen Rea

Stephen Rea Jay Griffiths

Jay Griffiths Kristen S Kurland

Kristen S Kurland Ron Jeffries

Ron Jeffries Derek M Steinbacher

Derek M Steinbacher Baby Professor

Baby Professor Ron Douglas

Ron Douglas Jeremy Klaff

Jeremy Klaff Nathaniel Rich

Nathaniel Rich Nikki Ace

Nikki Ace Mike Chambers

Mike Chambers David Graeber

David Graeber Rachel Kowert

Rachel Kowert Robin Yocum

Robin Yocum Liv Ryan

Liv Ryan Tovah Feldshuh

Tovah Feldshuh Forrest Maready

Forrest Maready Louis Martin

Louis Martin Danil Zburivsky

Danil Zburivsky Chuck Weikert

Chuck Weikert Andrea Lankford

Andrea Lankford Rod Powers

Rod Powers Karl E Peace

Karl E Peace K Moriyasu

K Moriyasu Jessica Nordell

Jessica Nordell Patrick Pickens

Patrick Pickens Mandee Heller Adler

Mandee Heller Adler Roland A Boucher

Roland A Boucher T L Payne

T L Payne Rebecca P Cohen

Rebecca P Cohen Ashley P Martin

Ashley P Martin Colby Coombs

Colby Coombs Dean Beaumont

Dean Beaumont William D Lopez

William D Lopez Kevin J Gaston

Kevin J Gaston Johnson Egonmwan

Johnson Egonmwan Robert Urban

Robert Urban Seth Lloyd

Seth Lloyd Paul Cobley

Paul Cobley Jules Brown

Jules Brown Walter Beede

Walter Beede Jeffrey T Richelson

Jeffrey T Richelson Jeanne Godfrey

Jeanne Godfrey Mark Verstegen

Mark Verstegen Angeline Boulley

Angeline Boulley Richard Lee Byers

Richard Lee Byers Connie Schultz

Connie Schultz Rick Vaive

Rick Vaive Jeffrey Bernstein

Jeffrey Bernstein Richard A Muller

Richard A Muller Gregory J Davenport

Gregory J Davenport Carol Ann Gillespie

Carol Ann Gillespie Lucy Postgate

Lucy Postgate Belinda Norton

Belinda Norton Bernd Heinrich

Bernd Heinrich Mark Lester

Mark Lester George Megre

George Megre Joan Jacobs Brumberg

Joan Jacobs Brumberg Jonah Lehrer

Jonah Lehrer Siena Cherson Siegel

Siena Cherson Siegel Rebecca Eanes

Rebecca Eanes Sylvester Nemes

Sylvester Nemes Tim Hannigan

Tim Hannigan Serena B Miller

Serena B Miller Kathryn Miles

Kathryn Miles Daddilife Books

Daddilife Books Kelly Corrigan

Kelly Corrigan S L Macgregor Mathers

S L Macgregor Mathers Bob Clouser

Bob Clouser Elizabeth Hunter

Elizabeth Hunter Mometrix

Mometrix Christian Heath

Christian Heath Johnny Molloy

Johnny Molloy Joe Berardi

Joe Berardi Erich Fromm

Erich Fromm Tania N Shah

Tania N Shah Margaret M Quinlan

Margaret M Quinlan Warren St John

Warren St John Natalie Rhodes

Natalie Rhodes Robert Kirk

Robert Kirk Irene Gut Opdyke

Irene Gut Opdyke Stewart Shapiro

Stewart Shapiro Scott Turner

Scott Turner Michael Anthony

Michael Anthony Matt Vincent

Matt Vincent Tj Faultz

Tj Faultz Neveen Musa

Neveen Musa Stefanie K Johnson

Stefanie K Johnson Donald R Prothero

Donald R Prothero Third Edition Kindle Edition

Third Edition Kindle Edition Ashley Rickards

Ashley Rickards Patrick Ejeke

Patrick Ejeke Brian Cain

Brian Cain Troy A Hill

Troy A Hill Christian Wiggins

Christian Wiggins Emily Nielson

Emily Nielson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

W.H. AudenFollow ·18.4k

W.H. AudenFollow ·18.4k Don ColemanFollow ·9.3k

Don ColemanFollow ·9.3k Noah BlairFollow ·7.5k

Noah BlairFollow ·7.5k Hamilton BellFollow ·12.9k

Hamilton BellFollow ·12.9k Diego BlairFollow ·15k

Diego BlairFollow ·15k Jan MitchellFollow ·8.4k

Jan MitchellFollow ·8.4k Benji PowellFollow ·8.1k

Benji PowellFollow ·8.1k Houston PowellFollow ·19.9k

Houston PowellFollow ·19.9k

Devon Mitchell

Devon MitchellDelve into the Comprehensive World of Cartridges: A...

In the realm of firearms, cartridges stand...

Joseph Conrad

Joseph ConradTales From The San Francisco 49ers Sideline: A Look...

The San Francisco 49ers are one of the most...

Ervin Bell

Ervin BellArcGIS Desktop 10: A Comprehensive GIS Tutorial for...

Geographic information...

Reed Mitchell

Reed MitchellPhysiology Pretest Self Assessment And Review 14th...

Accurately gauge your physiology knowledge and...

Devin Ross

Devin RossLost At Sea: The Unbelievable True Story of the Jon...

In 2009, journalist Jon Ronson set out to...

Shane Blair

Shane BlairModes of Thinking for Qualitative Data Analysis

Qualitative data analysis is a complex...

4.2 out of 5

| Language | : | English |

| File size | : | 4824 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |